Don’t have any time but want the gyst? Read the TL;DR

Grab yourself a fair-trade latte and put on that do-not-disturb because, today, we’re learning some skills. With about 15 minutes, you should understand how to use options in your crypto portfolio.

If this feels daunting, don’t worry. It’s not very complicated! I feel like there’s been a major incentive for TradFi to make options look really complicated as justification for laws denying the majority of people the ability to use them. I mean…

Casinos ✅ Legal

Sports betting ✅ Legal

Lottery ✅ Legal

30 year mortgages ✅ Legal

Options…. ❌ Only with a license!?!

…does anyone still really believe that the SEC/government’s motivation is really “protecting” people at this point?

Anyways, politics aside, I think this is a very useful skill to have – how to short crypto assets. For a deeper dive into crypto options, beyond simply shorting, check out this article.

What You Will Learn:

What are options

Step-by-walkthrough of how to purchase crypto options: There are many platforms you can use, but we’re going to share our favorite / the one we think is easiest: Lyra. On Lyra, you can short BTC and ETH.

The links for Lyra – an options trading DEX– are affiliate links which gives me some rewards if you end up choosing to trade on Lyra. If you don’t want to support me with an affiliate link, here is a non-affiliated link as well.

Index:

To be clear, I am not personally shorting crypto and this isn’t a recommendation or analysis on whether this is a good idea. However, there is obviously a time and place for it.

How To Short Crypto

The number one reason you should understand options, as a beginner, is because, I think they are absolutely the best way of hedging your portfolio against downside. I would much rather purchase an ETH Put when I’m feeling like the market is a little bit too high, then sell some of my beloved ETH. To protect against a big ETH drop using options is not very expensive and the payout could easily be 10-20x the initial cost.

Now when we say “shorts” or “longs,” there’s not actually an asset called a “short.” Short selling refers to borrowing an asset, selling it, and then rebuying it later on in order to repay the loan (hopefully for a cheaper price than you borrowed it for). However, we often refer to shorting an asset to mean: any strategy in which one is betting on the asset decreasing in value, while “Longing” refers to betting on the asset increasing in value.

There are two types of options and a whole variety of strategies you can build using them:

Puts: A contract to sell an asset at a specific price (known as the strike price) on a specific day in the future.

Call: A contract to buy an asset at a specific price (known as the strike price) on a specific day in the future.

Both of these options can be used to both short and/or long an asset.

The value of being right can be very, very high with options.

So How Would I Actually Use Options To Short Crypto?

We usually use Puts to short crypto assets. You might have caught on that both Calls and Puts can be used (if you want to explore that more, check out this article), but Calls are a bit more complicated in this scenario.

So, we’ll focus on Puts!

When I buy a Put, I am buying an agreement with someone to sell an asset at a future date. In this agreement I have to decide several things:

The expiration date

Which asset

What price do I want to be able to sell that asset for? (the Strike Price)

For example, if I think ETH is going to keep falling, I might buy a Put with a strike price of $2000 for May 01. Depending on the type of option, this means, that I can exercise my option and SELL 1 ETH on May 01 for $2000. This is really good for me if ETH is less than $2000. If ETH is $1600 on that day, I’ll make $400 per option. I could also sell the option on the open market before May 01, although there’s no guarantee what price I’d receive.

Why wouldn’t I buy a Put for $3000?

Clearly, having an option to sell ETH for $3000 in this scenario would be better! The thing is though that they’re much more expensive. The higher the strike price, the higher cost of the Put Option. This is because my counterparty is more likely to lose in this case.

So…we need to analyze the cost of the option alongside the risk and potential upside.

On a side note, some options are called American Options which can be exercised before and up until the expiration date. But Lyra doesn’t support these types of Options. However, even with Lyra’s options (called European Options), you could always sell the option on the market before it expires.

How To Short Crypto With Options: TL;DR

To “short” an asset, we can technically use several different methods. However, I’m going to focus on the easiest one, as demonstrated by my friend, which is to buy Put Options:

How To Short: We want to buy Puts above the price we expect the crypto assets to be at which allows us to sell for a profit.

As a real life example, let’s say we think ETH is going to keep dropping past $3350. Let’s say we think it will hit $2500 by May 01. In this case, we should buy an ETH Put with a strike price above $2500 to make a profit.

The higher the strike price (in compared to the actual price of ETH), the more we will make. But also, the more the option will cost.

A Real Life Example:

The following prices reflect the date when I wrote this article – Friday, March 29.

Let’s take a real example to cement this.

My friend decided that he wanted to purchase ETH options. He went to Lyra and purchased “x” amount of put options on Lyra. He bought Puts for ETH @ $2,600 on April 26th. This means that, on April 26th, he has the right to sell x amount of ETH for $2,600. If ETH is $2000 on that date, he would make $600 per option. If ETH is $0, he would make $2,600 per option. Considering these options cost $38.50 per option, that would be almost a 15x return if ETH hits $2000. There is also a fee involved that has to be considered (about $2 per option in this case).

You may ask, how do I exercise the option on that date? Do I actually need to own ETH? The answer is that no, you don’t have to. On the expiration date, Lyra automatically settles the trade. If ETH is below the strike price, the counter party has to pay you the basis (which is the price difference between the option and the underlying asset).

Not all option markets have automatic settlement.

What risk did my friend take here?

The risk is that the price of ETH is above $2600 on April 26. Assuming that’s the case, he would simply not exercise the option. It would expire and he would have spent that $39.80 per option for nothing.

The other risk that needs to be noted is the counterparty risk, which is specific to the platform you are trading on. This is the risk that the counterparty doesn’t pay up when you win. You can read more about this here. So ONLY USE REPUTABLE PLATFORMS WITH GOOD RISK MANAGEMENT RULES!!

Why Would You Short Crypto?

You don’t have to believe the entire crypto market is going to collapse in order to purchase Puts. They can actually just be a really good way to hedge without selling a bunch of crypto. Let’s say I want to hedge my position a bit. Let’s say I own 10 ETH – worth about $36,000 right now. If ETH drops to $2000, I would lose $16,000. Now, I could always sell some of my ETH to hedge. But, instead, consider if I bought 20 put options for ETH with a strike price of $2600 on April 26.

If ETH drops to $2000, I will lose $16,000 of the value of my ETH, but I would make $9,400 ($12,000 minus the strike price which was $2600) through my 20 options, which would greatly offset my losses. If ETH keeps running up towards $5,000, the most I can lose is about $800 from my puts (20x the price of puts which is $39 right now).

How Much Can You Lose?

The appeal of options (and probably why you need a TradFi license to deal them) is because the potential upside and downside can be immense.

For our purposes, if you’re buying Puts, you can only lose up to the amount you spent on the options.

If you were selling Puts, you could lose A LOT more. But that’s advanced stuff, so we’re not going to go into that now. Click here for more.

Why Don’t We Use Perps?

Perps can also be used in this situation. However, Options are more exact (because you have to decide WHEN the price will drop). But, they also allow for higher winnings and no chance of liquidation (at least in our scenario).

For more info on this, read this article.

What Platform Should I Use?

Your options here (haha, see what I did there), are either a centralized exchange or a decentralized exchange. I don’t think we need to go into the advantages and disadvantages of both.

I will be publishing a compare and contrast in the future, but for now, we’re going to use Lyra. Lyra is well respected in the space, has been around longer, and all collateral is held on-chain. The only thing that is centralized is the order book.

Lyra is also very convenient because they autosettle, so you don’t have to remember to do anything on the day of expiration for your options. Lyra is also giving out trading rewards right now.

Understanding a Crypto Options Marketplace

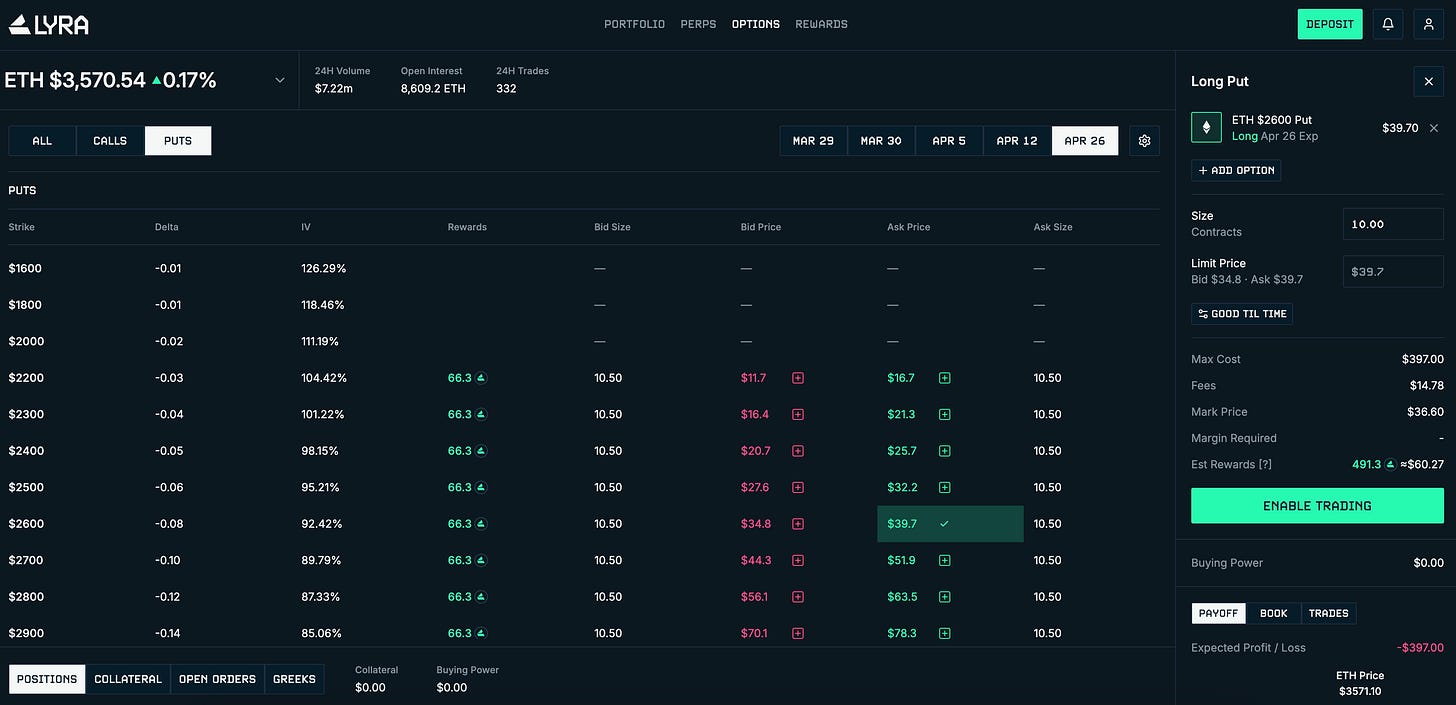

For this example, we’re using Lyra’s dashboard. As you can see, a Put Option looks like this:

Column 1: Strike ($3000): The price you will be able to sell the asset on the expiration date.

Column 2: Delta (-0.18): The difference between the option asset price and the current price today (0 means no difference, so -0.18 means an 18% drop

Column 3: IV (84.53%): The percentage – in comparison to today’s price – of the options asset price (in other words, $3,000 is worth 84.53% of today’s ETH price of $3547.

Column 4: Rewards (90.4): The bonus rewards for one purchase of these options contracts that Lyra is offering – worth about $8 at today’s price.

Column 5: Bid Size (30.00): How many of these contracts Lyra would be willing to buy from you right now

Column 6: Bid Price ($81.7): How much Lyra will buy one of these contracts from you.

Column 7: Ask Price ($91.9): How much one of this contract costs. 1 contract means the ability to sell 1 ETH at that price (i.e. 1 ETH at $3000 on the date of the contract)

Column 8: Ask Size (59.31): How many of these contract are available for purchase right now.

Simply, when we refer to a Put Option, I’ll write it like this:

ETH with a strike price of $3000 on April 26 OR ETH at $3000 on April 26.

A Step-by-Step Guide To Shorting Crypto with Put Options

Ok, so lets assume that you want to do this.

Here’s one way to short ETH or BTC:

Choose your platform. In my friend’s case, he used Lyra – and by using Lyra right now, you make yourself eligibility for their trading rewards. Lyra supports Bitcoin and Ethereum Put and Call Options. You can also buy leveraged perps.

Navigate to their “Options” tab and select BTC or ETH. You can also check out their Perps section which allows for trading with leverage.

Select “Puts.”

Decide when and the strike price you think ETH will be. In my friend’s case, he thinks that ETH will be worth $2600 on April 26. Select your date. Currently available are two days in advance, April 5th, and April 26th, May 31, and June 28.

Select the Put you want and then enter in how many you want to purchase. You will see the costs including the Max Cost (how much it costs) and the Fees (the additional cost of the transaction). The Mark Price is the average between the Bid and Ask price (i.e. an estimation of the fair market value of this contract).

Now what happens?

Now, essentially, you’ve made a bet that ETH will be below $2600 by April 26th. If ETH is under that price on that date, you’ll make money (you’ll make the difference between the option’s price and the price of ETH). If ETH is above the option’s price on that date, you’ll basically just let the contract expire.

Do I Need To Do Anything On My Expiration Date?

Nope! The nice thing about Lyra is that your contract will auto settle. You don’t need to remember to do anything on your expiration date.

If you want, you could sell the option before the expiration date. You might make money this way, especially if the market moved in your favor. But, you will likely make more money (if you’re right) waiting until settlement day.

Let’s Review The Risks

The risk you would be taking with a Put Option trade is that ETH (or whatever the underlying asset is) is above the strike price of your option on the expiration date. In my friend’s case, the risk is that ETH is above $2600 on April 26. In that case, you would not make any money, your contract would expire, and effectively, you would lose the money you spent buying this contracts.

The other risk you are taking is associated with the platform you are using (in this case Lyra). Since you are basically betting on the price of the asset, when you win, someone loses. Because you’re buying a Put Option, all of your risk is up front (because, if you lose the trade, you simply lose the amount you originally paid for the contract). However, the person on the opposite side of that trade has all their risk on the backside of the trade.

An example of this is with my friend’s trade. If he loses, he just loses the capital he posted to buy those contracts. But his counter party must now buy his contract on the expiration date for the difference between the contract’s strike price and the underlying asset. So why would anyone do that? The reason is because the counterparty must post collateral to enter into the trade. So, it’s up to us to verify with the platform that they require adequate margin amounts and have adequate liquidation policies to guarantee we get our money at the end of days.

Can We Trust Lyra?

Here’s the god-honest truth. As far as I can tell, yes. Buuuuut, I haven’t yet finished my deep-dive review of Lyra where I will compare and contrast it with other competing platforms.

However, the team and platform has a good reputation in the space. They haven’t fucked up until now. They’re on-chain so your collateral is safe and everything is transparent. As far as I can tell, they have good risk management policies. And they have excellent support on Discord.

But, as I said, I can’t wholeheartedly tell you it’s safe from my own two eyes. I personally trust it enough to use it, and so do people I know, but please DYOR if this is not enough for you.

Parting Words

I had a lot of fun writing this article and I learned a lot. I plan to implement some of these strategies in my own portfolio. Honestly, I think buying Puts is a way better strategy when you’re nervous about crypto’s potential downside than simply selling your crypto.

But, as always, this is real degen stuff, so DYOR, don’t put in anything you’re not willing to lose, and please, make sure you have a really strong understanding of this before engaging in options trading.

From here, you can expect to read:

Updates on how my friend’s trade is going

A compare and contrast between options DEX platforms and a look at whether LYRA token is a good investment

Option strategies

Peace ✌️

As always, none of this is financial advice. I am not telling you to buy or sell anything, just sharing my underlying research and conclusions.

I do hold a portfolio of cryptocurrencies. I was not paid by anyone to write this article. I do not hold Lyra’s token. I do not hold any option positions on Lyra or anywhere else at this moment.

If you would like to support this writing, please, leave me a comment (I love your feedback), pledge on Substack for when/if this newsletter ever goes paid-mode (you won’t be charged, only if/ever we make this paid):

…or you can buy me a cup of coffee or send some ERC20 tokens my way!

ERC-20 Address: 0x4F9960B2A808e8083C2D12420Aba4496D10e6D37

Thanks so much Noam. I'll be saving this to refer back to. I really appreciate your educational writing. Keep it up!