Why f(x) Protocol Is The Most Interesting DeFi Protocol You Haven't Heard Of

A Deep Dive into f(x) Protocol and FXN

I’m writing this because I’ve spent my last two weeks eating carrots at the bottom of this rabbit hole. I told @DefiBetaTesta a few weeks ago to tell me if he found anything he thought was game-changing. Fast forward a bit and I get this…

So here we now are today and both BetaTesta and I have emerged, bleary eyed and generally a bit shaken, from our weeks in the rabbit hole.

An Intro To f(x) Protocol

Where should we begin? It’s a bit hard to decide how to frame f(x) Protocol. Is it a stable coin project? Or maybe we should focus more on the functionality it enables within the ETH ecosystem?

Let’s first talk about what it is and how it works. Then we’ll explore the implications.

Very briefly:

f(x) Protocol potentially unlocks a game-changing stable coin alternative f(x)USD and we need to understand all of the stables that came before to properly compare.

f(x) Protocol offers a set of powerful possibilities within the ETH ecosystem, including:

A way to gain native-ETH yield without exposing yourself to the volatility – like a crypto savings account if you will.

An easy to use way to get exposure to leveraged ETH

They have $45 million in TLV right now.

Before we go on, I highly recommend you read this article first, since it’s really important to have a strong understanding of the ecosystem so that you can understand why what f(x) Protocol is doing is unique:

f(x) Protocol ELI5

f(x) Protocol’s uses collateral like many other DeFi protocols. Right now, f(x) Protocol uses stETH as their collateral – staked ETH – but they will allow other LSTs in the future (LST stands for Liquid Staking Token which, essentially, is the token that represents a deposit in an ETH staking protocol like Rocket Pool or Lido).

The advantage of stETH is that it allows the protocol to capture the native yield of ETH. As you’ll see, they put it to good use.

Isn’t stETH More Risky?

You might say, “but isn’t it more risky to use stETH, since now we have to also trust the Lido Protocol?” This is fair and there is additional protocol risk involved. However, I’ll make the same point I heard the f(x) Protocol team make in an interview. At this point, there is so much ETH deposited in Lido, that a failure of the Lido protocol may very well result in a failure of the entire ETH ecosystem. In other words, it’s not really that by not using stETH, f(x) Protocol could protect themselves from Lido. They would just be forfeiting the native yield.

How Does f(x) Protocol Work?

After depositing stETH, a user can withdraw one of two assets:

fETH

xETH

What is fETH?

fETH tracks the price of ETH, but only 10% of it. In other words, if ETH goes up $100, fETH goes up $10. It’s like a stable coin but pegged to ETH, not USD – so no inflation risk. It’s currently overcollateralized by 265.65%.

If you deposit your fETH into the Rebalance Pool, you get distributed the native yield from the ETH. This yield is usually much higher than the normal ETH yield since you’re earning – not only for your deposited stETH – but for every deposited stETH who’s depositor did not stake their fETH in the Rebalance Pool. Make sense? If you and I both put in 1 ETH and we take out 1 fETH, but I’m the only one who deposits my fETH into the Rebalance Pool, I get double the ETH yield (your yield and my yield). The current yield ranges between 16-30%. A bit of the stETH goes to the protocol itself too to be used in the Emergency Fund and for development costs. But, as my old man taught me, there ain’t no such thing as a free lunch. We’ll explore the additional risk taken on by depositing into the Rebalance Pool below.

Now, you might ask…what/who absorbs the volatility? This is a key question and one I talk about a lot in the stable coin article. Every protocol need some method for handling the volatility, unless you want to collateralize with fiat.

f(x) Protocol does this by distributing the volatility to another token: xETH.

What is xETH?

xETH absorbs the volatility. xETH is a leveraged token which means that it ranges between 1-4x leverage on ETH’s price. In other words, if the leverage on xETH is 2, then for every 10% price movement on ETH, xETH moves 20%. And so on.

The reason the leverage ranges is because it depends on the volatility of ETH. As ETH goes up faster, the leverage on xETH becomes less (mostly because the collateral amount is increasing AND because there is more demand for leverage). If ETH’s price drops quickly, the opposite happens and leverage goes up. Since it automatically adjusts, you don’t need to adjust your position ever and there’s no risk of liquidation. xETH is a good thing to hold if you’re pretty confident ETH will be going up in the long run, and you want increased exposure to that (because why wouldn’t you if you’re confident), but don’t want to have to manage your position or risk liquidation.

What’s brilliant here is how they turned the volatility of ETH into a separate product. Instead of trying to get rid of it, the fETH/xETH relationship opens up two different markets catering to different risk profiles.

What is the f(x) Protocol Rebalance Pool Risk?

Great. You’re with me until now?

Let’s say you deposit stETH and withdraw fETH but now you want to deposit your fETH into the Rebalance Pool to harvest some of that delicious native ETH yield. What’s the risk?

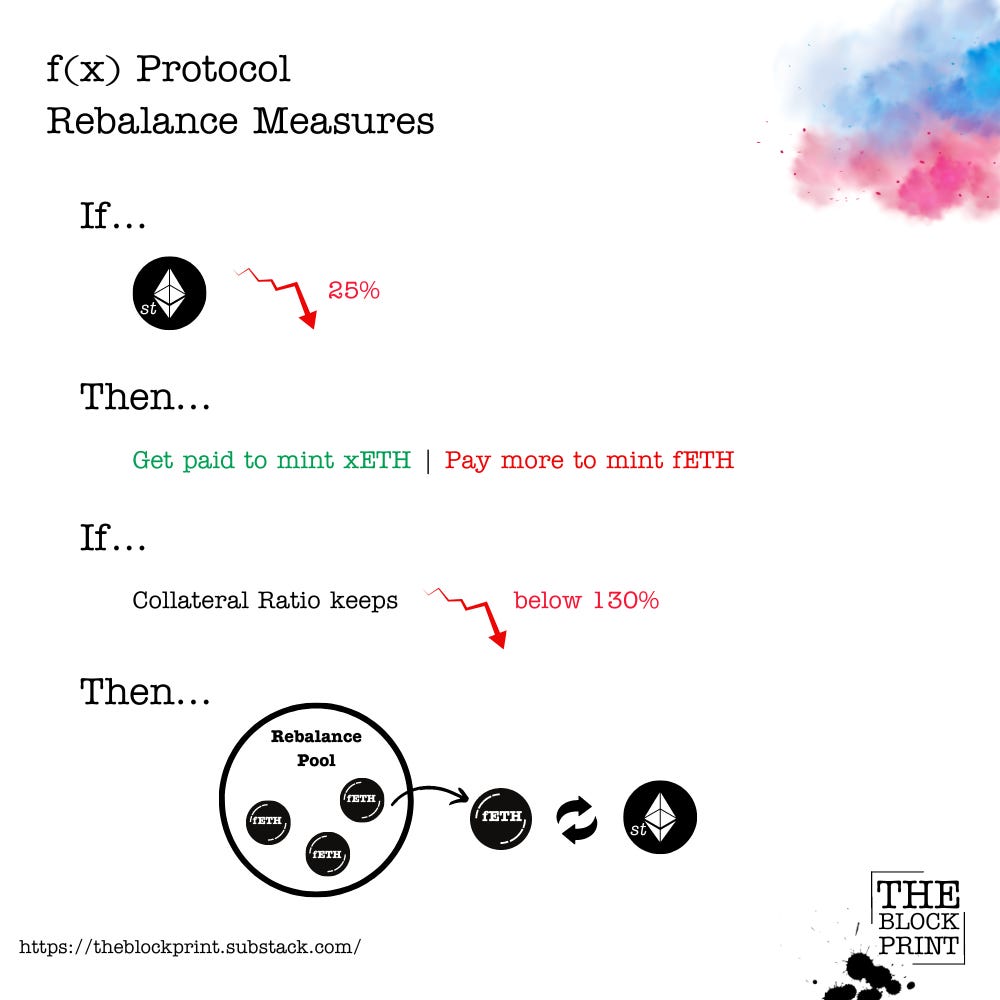

Well, the Rebalance Pool acts as a security barrier in case the value of the stETH in the collateral pool every devalues significantly. More specficially, if stETH ever drops more than 25% in a single day (which would be the largest price movement ever for ETH), the Rebalance Pool comes into play:

The protocol would put in minting incentives for xETH and a slight minting penalty on fETH. Why? Because, if the price of ETH fell dramatically, the protocol would need more people to purchase xETH (to absorb the volatility).

A little bit of minted xETH increases the Collateral Ratio significantly (if it’s not clear why, consider how a 4x leveraged asset essentially is like putting 4 times the original asset in as collateral). So the hope is that by incentivizing people to mint xETH, they’ll even things out. These incentives come from protocol revenues.

If the collateral continued to drop and the Collateral Ratio reached below 130%, any fETH in the Rebalance Pool would be used to buy more stETH. The risk here for fETH holders is not super high – since essentially – in the worst case scenario, your fETH would be used to buy the dip. However, you would need to keep an eye on it, since you would now be exposed to the full volatility of ETH.

If neither of these can get the CR back up and ETH kept crashing, xETH would go to $0 and essentially have infinite leverage. fETH would have full claim over the remaining ETH.

The Worst Case Scenario for f(x) Protocol

Ok, let’s look at what the worst possible outcome is for anyone depositing stETH into the protocol.

Obviously, a full protocol hack would be the worst and that risk is present anywhere on DeFi.

Assuming you’re comfortable with that risk, the worst case scenario is:

For fETH Holders:

Your fETH becomes stETH. That’s it. That’s the biggest risk here.

For xETH Holders:

Your xETH goes to zero. This is really like any leveraged position – it can go to zero. Recognize though that even if it did go to zero, it doesn’t mean that it’s worthless. The leverage on that token would be insane and ANY upward price movement from ETH would put you back in business.

All in all, there’s no risk of totally losing your deposit with fETH and that’s what I love about this system. There is also no risk of liquidation with xETH which is a huge benefit for anyone not looking to actively manage their leveraged position.

What Is f(x) Protocol Solving?

The way I look at f(x)Protocol is that they are offering a novel approach to the two biggest challenges facing DeFi projects:

If we choose to use an on-chain asset with native-yield, how do we account for the volatility?

Is it possible to peg a stable to something other than fiat?

As I’ve said before, native ETH yield is the new hottest thing for developing DeFi protocols. f(x) builds a system around ETH yield that both protects against volatility and provides easy exposure to leverage.

I think that what f(x) Protocol does so well is it looks at the volatility of ETH looks as a feature. They realized that, for some, volatility is a drawback (those who seek stability), but for others, it’s literally something they pay for. It’s called going long and there are markets built around providing long exposure to volatile assets.

What f(x) has done is essentially set up a market between those who want a stable token pegged to ETH, earning yield in ETH, and those who want greater exposure to the upside of ETH. I think of it kind of like a pool. For every one person who deposits ETH into the pool and takes out fETH (which is the more stable asset), there’s someone else who is willing to buy that risk from the other guy. This person acquires xETH, which is an ETH-tied token that provides between 1-4x leverage.

The Value of an ETH-Pegged Stable

It’s also awesome that we are getting a stable pegged to ETH! I think that this is how a DeFi oriented stable coin will look. In other words, we’ll have multiple different types of stable coins including dollar pegged coins, dollar collateralized coins, commodity collateralized coins, etc, but the stables used within the Ethereum ecosystem will primarily be an ETH-pegged stable. This also totally eliminates the risk of dollar inflation.

I mean, if we believe in an economy – even just a digital economy – run on Ethereum, then it makes sense. It’s ridiculous to think we would continue to use a stable pegged to the dollar. However, the big question up until now was how to peg a stable to the price of ETH when ETH is so volatile. I think f(x) Protocol’s solution to this is brilliant. Offer a leveraged product (xETH) to absorb the volatility and have the ETH-pegged asset only take on 10% of the volatility.

Who Would Use f(x) Protocol?

I like to think of this in terms of who is the customer for each product. Ultimately, one of the team members made a good point in the interview, which is that Aladdin DAO (the DAO behind the project) wanted a stable that they could use in their own DAO’s treasury. But they didn’t trust any of the alternatives (for reasons we discussed in this article). So they built it.

fETH

fETH provides 10% of the exposure to the price of ETH. If ETH goes up from $1000 to $1100, fETH goes from $1000 to $1010. The same holds true in the case of a drop. But, if you’re willing to deposit your fETH into the Rebalance Pool, you will receive the native yield from ETH (plus a bonus since not every fETH holder will deposit their fETH into the pool and only pool depositors get distributed the yield from the stETH).

So the type of person that I think would want fETH is a person that wants a stable token, priced in ETH (so not exposed to the inflation of the USD), with ETH-native yield. It’s like a crypto savings account. Also, since the yield is coming in as ETH, that’s a huge benefit for anyone bullish on ETH. I could see cycling some of my profits into fETH from this current bull run.

There is no risk of a bank run with fETH. The only risk is that it’s converted back into ETH. In other words, the only risk is that it stops being a stable coin and just starts tracking the price of ETH again. There is also no risk of fiat inflation.

xETH

The person who would want xETH is someone who wants to go long on ETH without the risk of getting liquidated. With xETH, you have a token that adjusts the leverage based upon the fluctuating price of ETH. Because it’s adjusting the leverage amount for you, you don’t have to manually do this. Also, you have no risk of liquidation, because the f(x) Protocol system does not depend on overcollateralization. It’s feeless, liquidation free, leverage.

The risk is that, if ETH crashed enormously, you would get wrecked, as with any leveraged position. The risk isn’t that you would be liquidated. The system is built to work normally for anything less than a 25% drop in the price of ETH over a 24 hour period. At that point, additional economic incentives are activated that encourage people to buy more xETH to absorb the volatility (which we discussed above). The only real risk here is that ETH goes to zero. That’s the only way you lose. But also, everyone loses. But also consider that as the price of ETH goes down, demand for leverage goes up (because people know/hope it will eventually go back up).

I could see converting some of my stETH into xETH to increase my exposure to ETH. This is great for someone who is really bullish on ETH but doesn’t have the amount of money liquid to get the level of exposure they want.

Future Potential Of f(x) Protocol

I’m just spitballing here, but f(x) Protocol seems to me to be super flexible. Imagine creating additional markets by playing with the leverage/stable settings?

For example, your standard pool featured 1-4x leverage of xETH and 10% of ETH volatility on fETH.

But imagine if you created another pool with 4-8x leverage of xETH and 5% of the ETH volatility on fETH?

Or, you could create a portfolio of xETH and fETH that gave you 50% exposure to ETH. Or 200%. There’s such potential to combine these assets into different baskets to make it very, very easy for people. I can imagine going onto to f(x) Protocol and finding a bunch of different offerings for every risk appetite.

A New Stable Coin: f(x) Protocol’s f(x)USD

f(x)USD is the protocol’s newest offering: a stable coin pegged to USD, backed by the collateral pools filled with LSDs.

Just as a note, the protocol will support more pools for various LSD (Liquid Staking Derivatives – like stETH or rETH). Right now, they only support stETH, but they say that there will be others that feature a leveraged/stable pair based on it.

From each approved pool – right now, only from the stETH pool – if you deposit the appropriate LSD (like stETH), instead of taking fETH or xETH in return, you can take f(x)USD. Essentially, we have an overcollateralized stable coin, pegged to the dollar, backed by ETH.

If you’ve read the stable coin article, you probably know what I think about this at this point. But if you didn’t here goes:

Pegging this token to USD is fine. Obviously, it exposes the holder to dollar inflation, but ultimately, at this point in time, people want this. I think that there will always be the need for fiat pegged tokens.

No USDC or treasury bond exposure here, which is great. I love having a dollar pegged token that is collateralized with ETH. Ethena is also doing this (and I hope to publish a deep dive into them soon) and I think we’re going to see a lot of projects do this soon.

No need for off-chain custodians, which is great.

The disadvantage of this is that anyone who withdraws f(x)USD, forfeits the yield to their stETH. This, in turn, increases the yield earned by everyone with their fETH still in the Rebalance Pool.

Something that does need to be considered is whether, by forfeiting the yield, f(x)USD can compete with products like Ethena. I want to write more about this, but will save it for a future article.

For more details, check out the team’s medium article.

What is FXN?

FXN is the protocol token for f(x) Protocol. You can lock up FXN to gain voting rights and to earn a portion of protocol revenues. The yield is currently at about 8%. You must lock up your tokens for 4 years (like with Curve) to earn veFXN which entitles you to 75% of platform fee revenue. 25% goes to the treasury.

Now, FXN can be used to direct emissions to different pools, just like with Curve. As more FXN is released into the market and earned through protocol fees, it is offered as rewards for existing stakers. Which token pools are awarded that fresh FXN is up to the governance system to decide.

I just want to highlight this point since it’s really the key to FXN’s value:

Imagine, as more and more LSD protocols (RocketPool, Lido, EtherFi, etc) recognize the value of f(x) pools, they will want to encourage liquidity to make sure that their token is the most widely in demand (i.e. if I can earn 30% staking stETH but 50% staking rETH, I’m choosing rETH). They can buy up FXN and vote in order to direct new FXN emissions to their pools. This also drives up overall market demand for their specific LSD. And there, at the end of the demand cycle, is FXN.

Should You Buy FXN, now?

Update:

As of March 15, the price is trending down towards $150 as predicted.

The price of FXN is just over $200. It’s at an $211 million fully-diluted market cap, however, 30% of the total tokens are permanently locked by Aladdin DAO, to be used for their voting rights, and will never be released into circulation. That means that the circulating supply really is about $148 million. Also, the total release schedule for the 49% of FXN which are released as liquidity incentives are on a slow drip over 50 years. That means, that the market cap really is even lower than that.

I’m sorry I didn’t get this article out sooner, because, when I started writing it, it was $95. Even more unfortunate is that I was not aware of this project in the fall of 2023 when it was trending at about $15. But, that’s why we wrote this stable coin article. If you understand the whole ecosystem, you can get an edge with which to identify projects with this kind of potential at that low market cap price.

Regardless, Frax’s governance token (FXS) is set at a $895 million fully diluted market cap and Curve’s governance tokens (CRV) is trending around the $1.7 billion in fully diluted MC. I think f(x) Protocol could prove to be similarly foundational to DeFi as these two protocols, but there are some developments that need to be made (see section “What We Still Need To See From f(x) Protocol” ) before that happens. So, for now, I could see it jumping into the $500-$600 million MC area which would represent a 2-3x from current prices. However, I think both FXS and CRV have yet to really explode in this bull run, so it’s possible all three take big leaps forward and, among the three, I think FXN has the most room to run. However, this assumes that the protocol keeps developing and avoids any major catastrophes.

If I was giving advice, which I’m not, but just telling you what I would do if I was trying to get into FXN, I would wait for a pullback to about $150 / token and then buy. I’ve been watching the market fluctuations for a couple months now and I’m nearly positive that FXN pulls back to that support before taking another run forward.

But also, what the hell do I know? I’m not a professional trader. I just like tech. So please please please, take this part with a huge heaping of salt. And for my lawyer’s sake. This is not investment advice!!

If you do want to purchase FXN, please go to the f(x) Protocol site and follow the links to the Curve pool. I don’t want to post any links here for obvious security reasons. But the Curve pool is the place to buy and…wait for a decrease in gas since FXN is only on ETH mainnet right now.

Who Is The Team Behind f(x) Protocol?

f(x) Protocol was founded by Aladdin DAO. First off, just how sweet is it that we are actually seeing viable applications produced by DAOs? It’s such a fascinating development.

Now, the team is anonymous, but they have a solid track record of projects. They’ve developed Concentrator (which has over $52 million TLV) and Clever ($14.3 million TLV). They have also built out infrastructure for their DAO. If you want to check them out more, you can go join their weekly community call on their discord.

You can also watch these interviews with some of the core DAO members on YouTube (1 and 2).

What I really like about this is, as they posted on Medium:

“As you might expect from an Aladdin project, there is NO team allocation, NO presale or VC involvement.”

What I see here is a collection of individuals, with a history of successful launches, building a product with a strong understanding of the DeFi space, and no outside incentives motivating their development.

This is still the wild west. We don’t have much precedent to look back on to judge how well DAO’s can build projects. We also don’t know how the strong arm of the law will refer to such a protocol. But from what I see, I’m willing to jump on for the ride.

What We Still Need To See From f(x) Protocol

There are some really key developments that need to come along.

First, and MOST IMPORTANT, is they have to get themselves on an L2, or two of them…or three. Right now, gas fees are outrageous, and even just purchasing FXN from Curve can cost upwards of $100. Interacting with the protocol is very expensive.

Second, they need better UI/UX. They’re aiming to be a very user-friendly protocol with set and forget leverage and other products. They need a very user friendly interface and a helpful walkthrough to get people to understand how to use their product.

Third, they’re only now launching f(x)USD with incentivized minting. We will have to watch how this develops. I think that they will be at a disadvantage to protocols like Ethena which offer native yield to their dollar-pegged stable coin holders. That makes it a much more attractive product to me than f(x)USD and I would like to see the f(x) team find a way to bring yield to that token as well. However, I want to personally research Ethena more and publish on it before I would be willing to recommend anyone use them.

Fourth, I want to see expanded liquidity across DeFi pools and more integrations with LSDs.

Fifth, I want to see the team able to really explain the value of fETH/xETH to the average crypto user and help them understand when they should be purchasing these assets given their risk profiles and the state of the market.

Final Thoughts About f(x) Protocol

I love the underdog and I am super excited to watch how the DAO-developed f(x) Protocol develops. At the same time, I think we’re going to see a lot of new launches building on native-ETH yield.

I’ve been so turned off in recent years by the VC-backed, airdrop-farming, pseudo pyramid schemes of many emerging protocols (I’m looking at you Blast!)

It’s super refreshing to see a functional, live product with $45 million in TLV being worked on by a team with zero outside incentives, and still under the radar. I think that they could end up being a core DeFi protocol.

Even if FXN doesn’t turn out to offer great returns, I think f(x) Protocol is offering some excellent applications into the Ethereum ecosystem – products that I will personally use – and I would keep a close eye on anything else coming out of the Aladdin DAO.

Finally, I will say that these are pretty risky investments and I have zero idea where they will go. Please, if you are going to invest, only invest what you’re ok losing. Simply holding BTC and ETH is probably a winning 10-year-strategy as it is.

Disclosure:

I do hold a portfolio of cryptocurrencies including some FXN. I was not paid by anyone to write this article. I did it on my own with time that earned me zero dollars.

Other Materials To Read About f(x) Protocol:

Risk Assessment of f(x) Protocol

Another Article About f(x) Protocol

As always, none of this is financial advice. I am not telling you to buy or sell anything, just sharing my underlying research and conclusions.

If you would like to support this writing, please, leave me a comment (I love your feedback), pledge on Substack for when/if this newsletter ever goes paid-mode (you won’t be charged now, only if/ever we make this paid:

…or you can buy me a cup of coffee or send some ERC20 tokens my way!

ERC-20 Address: 0x4F9960B2A808e8083C2D12420Aba4496D10e6D37